tennessee inheritance tax laws

The maximum Tennessee estate tax rate was 95 which is significantly lower than the federal maximum rate of 40. Hire a good estate planning attorney.

Tennessee Health Legal And End Of Life Resources Everplans

Next year the Tennessee Inheritance Tax will be abolished.

. Tennessees tax exemption schedule is as follows. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

Tennessee residents may wish to apply for an inheritance tax waiver if the decedent died between 2006 and 2012 and left an estate which is less than the exemption allowed heirs. What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state.

Beginning the Probate Process in Tennessee. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert.

Posted on Jul 29 2013 826AM by Attorney Jason A. The inheritance tax is different from the estate tax. There is no inheritance tax in Tennessee this would be tax that falls on the heirs and beneficiaries not on the estate of the person who died.

The inheritance tax applies to money and assets after distribution to a persons heirs. However it applies only to the estate physically located and transferred within the state between Tennessee residents. Create a revocable living trust.

Tennessee is an inheritance tax and estate tax-free state. The only situation where this tax might. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax.

How to avoid probate in Tennessee. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. There is a 25 per cent Farm Property Tax.

For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. Technically Tennessee residents dont have to pay the inheritance tax. Tennessee Inheritance Tax Is jointly held property considered part of the decedents taxable estate under Tennessee law.

Starting January 1 2016 for those who die on or after that date there will no longer be any Tennessee Inheritance Tax obligations. We have great news regarding changes in the inheritance tax laws that may impact you your family or your clients. There is a 40 per cent Commercial and Industrial Property Tax.

She has been in the accounting audit and tax profession for more than 13 years working with individuals and. There is a 25 per cent Residential Property Tax. As of January 1 2016 Tennessee no longer has a state inheritance tax.

Open bank accounts and designate heirs as beneficiaries of the accounts. There is a 55 per cent Public Utility Property Tax. Provided that stocks and bonds listed on recognized exchanges shall be appraised by ascertaining their quoted value on the date of death of the decedent or on the nearest.

Each due by tax day of the year following the individuals death. The inheritance tax is levied on an estate when a person passes away. This change means that going forward Tennessee estates will not pay Tennessee inheritance taxes so long as death occurs in 2016 or later.

Property and Inheritance Tax in Tennessee. This document is available on the website of the Tennessee government and should be filed with. As of January 1 2016 Tennessees inheritance tax is fully repealed.

Year Amount Exempted. Tennessee does not have an inheritance tax either. The good news is that Tennessee is not one of those six states.

Proving the Wills Validity. Due by Tax Day of the year following. Add a transfer on death deed to any real estate you own.

For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000. As well as how to collect life insurance pay on death accounts and survivors benefits and fast Tennessee probate for small estates. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. Today the Tennessee Inheritance Tax exemption for 2015 is raised to 500000000.

The great State of Tennessee imposes the following taxes. Prior to 2016 Tennessee imposed a separate inheritance tax and had an exemption from that tax that was less than the federal estate tax exemption. Lee Under Tennessee law jointly held property can be considered part of the deceased individuals taxable estate.

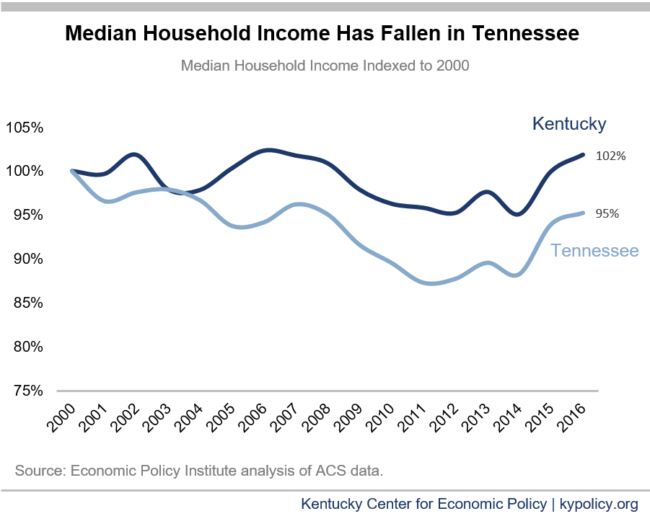

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be. Info about Tennessee probate courts Tennessee estate taxes Tennessee death tax.

Assets in excess of the federal exemption are. Federal estatetrust income tax return. Final individual federal and state income tax returns.

Inheritance Laws in Tennessee Probate in Tennessee. Probate is a court-supervised process that gives a family member such as a surviving spouse or. If the decedent left a will the probate process begins when an executor.

There is a 30 per cent Business Personal Property Tax. The federal estate tax exemption is 5450000 for 2016 and is indexed for inflation. Those who handle your estate following your death though do have some other tax returns to take care of such as.

The inheritance tax is paid out of the estate by the executor. A All property real and personal shall be appraised at its full and true value at the date of the death of the decedent. In January of 2016 Tennessee repealed its inheritance tax to encourage residents to continue to live and retire within the state.

The size of the exemption will increase until 2016 when the inheritance tax will be discontinued. Tennessee Inheritance and Gift Tax. For example the neighboring state of Kentucky does have an inheritance tax.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a.

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Tennessee Renunciation And Disclaimer Of Property From Will By Testate Mimument Of Title Tennessee Us Legal Forms

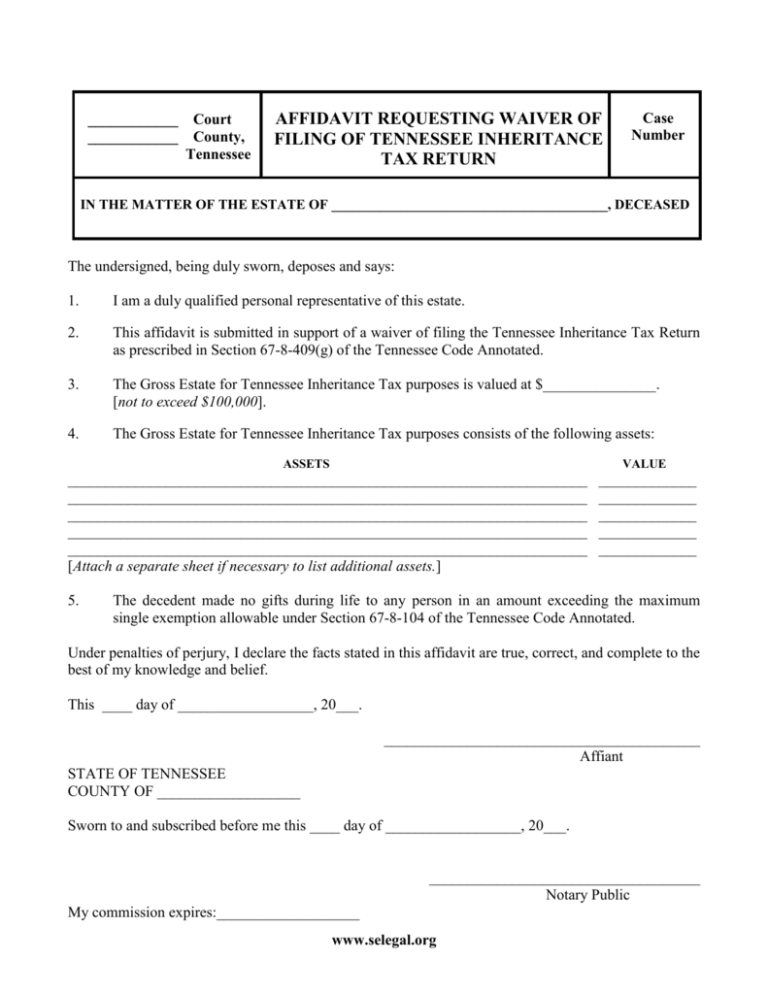

Affidavit Regarding Inheritance Tax Return

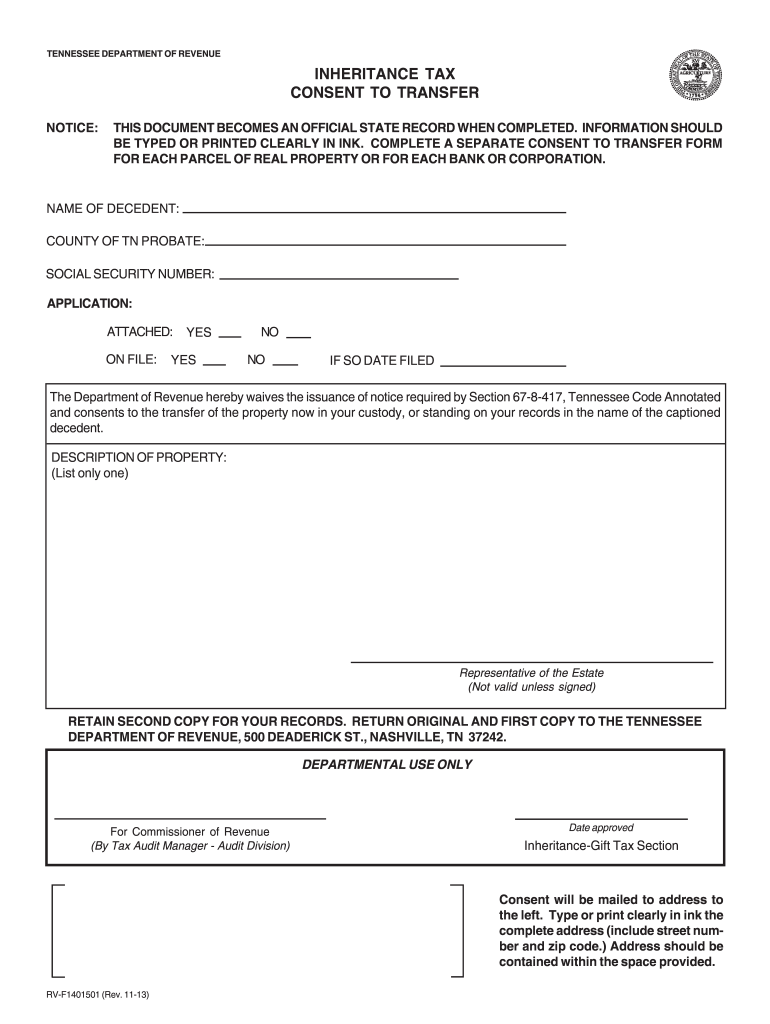

2013 2022 Form Tn Rv F1401501 Fill Online Printable Fillable Blank Pdffiller

Tennessee Last Will And Testament Legalzoom Com

Tennessee Property Assessment Glossary

How To Inherit Life Insurance In Tennessee

What Is Estate Planning And Why Do It Hermitage Mt Juliet Tn

State Estate And Inheritance Taxes Itep

Tennessee Probate Law How Does It Work 2022 Lawrina

Tennessee Education Laws Annotated Lexisnexis Store

Tennessee Corporations Partnerships And Associations Law Annotated Lexisnexis Store

Living Trusts Revocable Trust Trust Words Living Trust

Graceful Aging Legal Services Pllc Estate Planning Attorney Legal Services Estate Planning

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

Historical Tennessee Tax Policy Information Ballotpedia

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

What You Need To Know About Tennessee Will Laws

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc